Two years ago I decided it was time to add a bit of rationale to the equity crowdfunding market in the Netherlands. Do the crowdfunding valuations make sense or are the so-called friends, family and fools really just friends, family and – literally – fools?

Guestpost by Thomas Mensink

This is the third (and final) year in a row that I analyzed the crowdfunding valuations in the Netherlands based on data of the main crowdfunding platform Symbid. In the previous blogposts (2014a, 2014b and 2015) I concluded that the valuations have gone up in 2015, that I considered the average pre-revenue valuation high and that (too) high valuations could lead to funding issues later on.

But then again, what’s the value of a promise and who am I to decide if a startup priced too high? Only time can tell. Let’s look at some data first.

Data: Symbid

To find out what the crowdfunding valuation are, I looked at publicly accessible data from Symbid, the major equity crowdfunding platform in the Netherlands. Just like last edition, I collected Symbid data manually by browsing its website and searching its newsletter emails with upcoming crowdfunding campaigns. I excluded pledge, convertibles and one-off projects such as the movie ‘De Surprise’ from our sample. For 7 projects I did not have the data to calculate the valuation, resulting in a total research sample of 200 projects.

Crowdfunding valuations have again increased over the past year

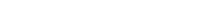

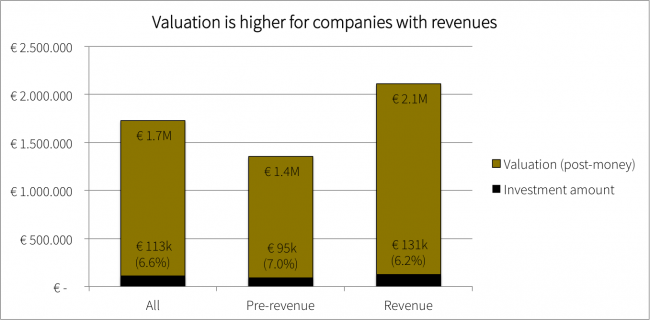

The post-money valuation is – unlike previous years – not provided anymore by Symbid (why?) but the calculations are simple: post-money valuation = investment amount/ % of equity. The average investment amount and valuation of all Symbid projects are presented in the figure below.

The average project on Symbid raises, or tries to raise, €113k in return for 6.6% equity. This corresponds to a total (post-money) company value of €1.7 million (median: €1.1M). How does this compare to previous years?

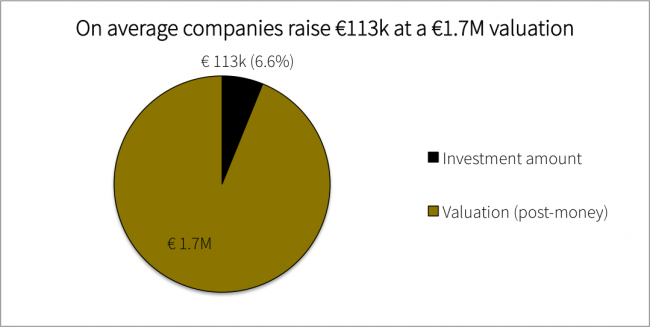

The valuations have gone up. The figure below shows that the average valuation of the projects per year increased from €1.4 million before 2015 to €1.8 million 2015 to €2.1 million in 2016 (and across all years €1.7M as mentioned). This corresponds to an increase per year of 23%. The average investment amount also increased, from €101k to €128k, but less equity was provided in return (7.3% vs. 6.1%).

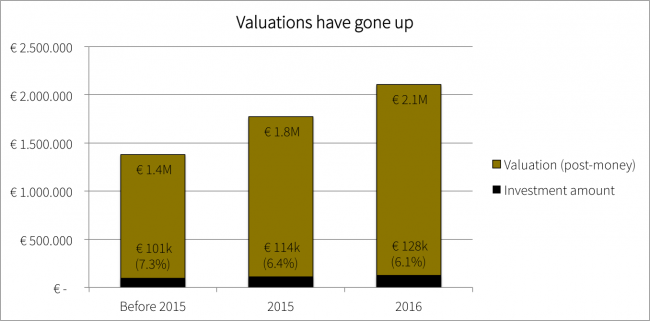

Interestingly, the valuations of the projects that were successful on Symbid (i.e. they raised 100% or more of their funding need) remained stable around €1.7 million in the last years. The average valuation of the projects that were not successful has on the other hand increased from €800k to €2.3M:

Did the crowd start to ‘punish’ companies with too high valuations by not investing in them?

What I find interesting here as well is that the average valuation of unsuccessful projects with revenue is €2.5 million – higher than the €1.8 million of successful projects with revenue – and the valuation of unsuccessful projects without revenue yet is €920k – lower than the €1.5 million of successful pre-revenue companies. Perhaps, but I’m just speculating based on some projects I saw, companies with revenue that do not succeed on Symbid are too arrogant (“let’s see if we could raise the money for this price”) and the companies without revenue do not succeed because they are too cautious (“it would be cool if we could raise the money to start our business, let’s try”).

Companies with revenues have higher valuations

Within the Symbid sample, I made a distinction between pre-revenue companies (N = 75) and companies that generate revenues already (N = 91) (the revenue status of the remaining 41 is unknown). The result is presented in the figure below.

As expected, the companies that generate revenue have a higher valuation than pre-revenue companies: €2.1M and €1.4M respectively. These numbers haven’t changed much compared to last year. The investment amount is this year slightly higher for revenue companies compared to pre-revenue (€131k vs. €95k). Again, I am surprised by the high valuation (in my opinion) of the pre-revenue companies. The nature of these companies is very diverse, but they have one thing in common: no paying customers. Yet they value their promise at €1.4 million and get away with it in many cases.

This year I also found some data to put the valuations of companies with revenue in perspective. Constantijn Lurvink, a business economics student, studied the valuation techniques of the companies on Symbid by comparing the valuation of the successful campaigns with the outcomes of different valuation methods that they applied (e.g. DCF, venture capital method and scorecard method) to see which technique provided the valuation closest to the deal valuation. (His findings: a combination of techniques with certain weight factors provides most often the value closest to the deal value). Using his data and looking at the companies with revenue and a successful campaign (N = 40, so a subset of my dataset), and compare their projected revenue for the year following the campaign (to make it easier to find comparable data) with their valuation, we find that on average the multiple equity value/sales is 12.4x. Not bad.

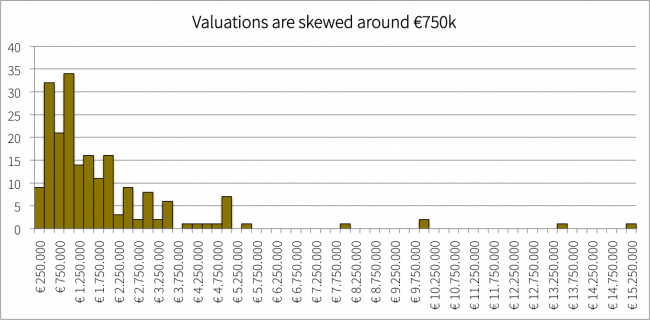

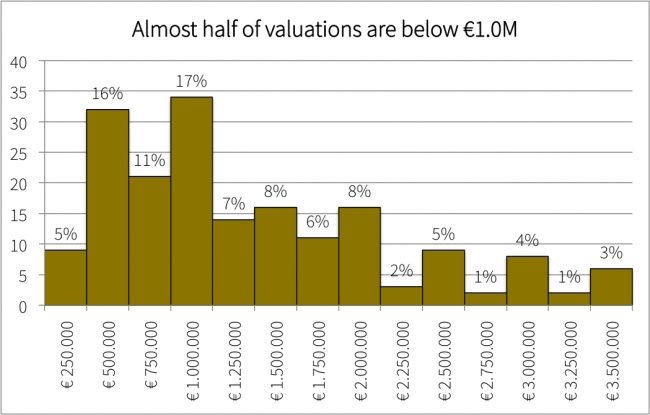

Valuations are skewed around €750.000

In order to see what valuations are most popular, I made a histogram containing the frequencies of the valuations of the crowdfunding projects. 48% of the crowdfunding projects have a valuation of €1 million or less, 91.5% have a valuation of maximum €3.5 million. Most of the projects (17%) raise funding at a valuation of €750k to €1 million. The highest valuation, a little over €15 million, is from Solarus. The most extreme pre-revenue valuation is Only Once (4th round): a little below €8 million.

Concluding remarks and thoughts

Compared to previous analyses, the valuations of equity-based crowdfunding projects have gone up. Companies with revenue raise on average at a valuation 12.4x their projected revenue. Companies without any revenue yet are raising or have raised (successfully) at an average valuation of €1.4 million. This sounds pretty optimistic to me and could have consequences in any follow-on rounds (i.e. no deal or downround, like I explained last two times). Obviously, the current equity stake of on average 6.6% will further dilute with every new equity round the company raises, resulting in a smaller slice of the pie for crowd investors than they might expect. But apparently there are enough friends, family and ‘fools’ that are willing to pay this price, so I guess these valuations are ‘market conform’.

This year we are probably going to see some crowdfunded companies that will cease operations. Not necessarily because their intrinsic business idea is bad but because that it just what happens with startups a lot. Aside from the crowd investors that will lose most or all of their investment, I can image that a larger number of crowd investors will get disappointed financially when the realized returns and/or their eventual ‘slice of the pie’, after sequential funding rounds, are below expectations. High valuations tend to lead to high expectations.

Like last year, I do hope crowd investors will sustain, even when some of their investments fail or disappoint. Therefore, I encourage investors to keep investing, not shy away from a rational approach (as well) if you aim for financial returns, and do challenge the crowdfunding valuation when you think they are too optimistic. Unfortunately, I noticed that both the explicit valuation and the challenge valuation button have been removed from Symbid. This doesn’t really contribute to the transparency I believe.

I also encourage entrepreneurs to really think through the next business steps, funding strategy (i.e. next financing rounds and dilution) and business risks, and be very clear and explicit about this in the project description. This especially holds for pre-revenue companies as they don’t have much to fall back on (yet) except for a well thought through plan backed by sound (financial and non-financials) assumptions.

This post was written by Thomas Mensink, analyst at Golden Egg Check. It also appeared on Golden Egg Check’s blog.

This post was written by Thomas Mensink, analyst at Golden Egg Check. It also appeared on Golden Egg Check’s blog.

Header image by Alejandro Alvarez