From start-up to scale-up to market domination in a European context. Companies planning to move into the next phase of their development must be able to finance their ambitions. Those that take the long-term view and a healthy focus on revenue generation stand the greatest chance of staying on course to success.

Approximately half of all Dutch start-ups fail within five years. We needn’t be too disheartened: one pan-European study found that only Austria, Belgium and Sweden fare any better. Nevertheless, fifty percent is a significant number. As a start-up, you must realize that merely having a kick-ass product is not enough. You need to sell your product or service. Equally important, you should follow the right financing strategy. In our experience, this is where many start-ups go wrong.

Employee or entrepreneur

First, let’s consider the very early days of the fledgling company. Launching a start-up is not something you should attempt alone. Assemble an entrepreneurial team that includes people with diverse skills and qualities. They must share your drive and your dream of conquering a particular market but they should bring different abilities to the table. Their expertise should complement your own. A common mistake founders make is to approach outside investors too soon. Not only are start-up entrepreneurs afraid to sink their own money into their idea, they are seeking approval. They use the investor to validate the concept and they hope to ‘hitch a ride’ on his or her experience. This can be an expensive lesson because they are likely to give up a very large share of the company before it has had a chance to prove itself. Founders like this lack daring. They want to test the market without giving up the security of salaried employment. They do not embrace the true meaning of entrepreneurship.

Earnings model

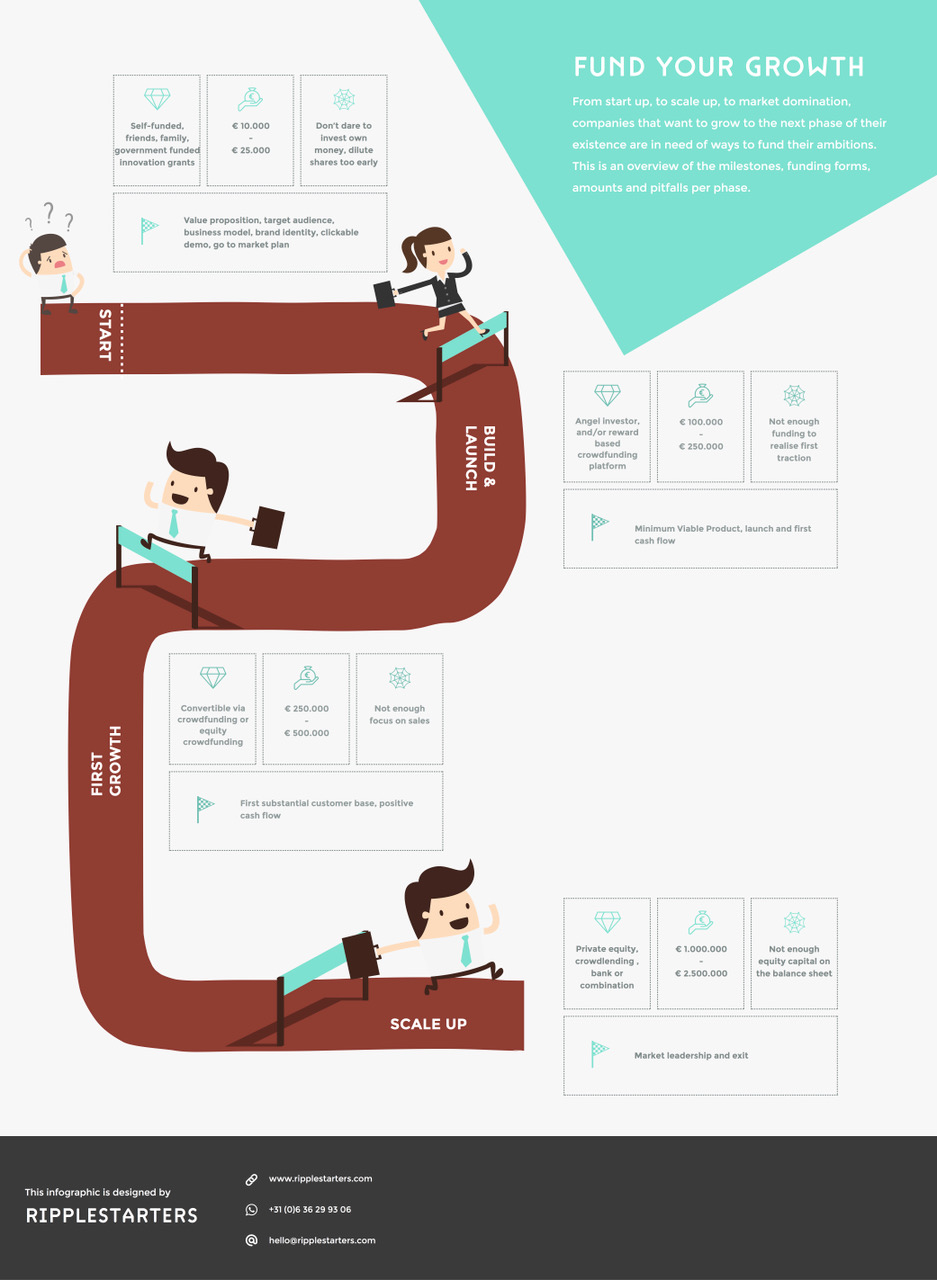

Most start-ups will need somewhere between €10,000 and €25,000 to see them through the initial phase. This money will usually need to be raised privately, perhaps drawing on the entrepreneur’s inner circle of friends, family, and fans. It should be spent on defining the value proposition, identifying the target group, developing an effective earnings model, devising a brand and identity, and – in the case of an online product – building a clickable demo. If someone is to validate the concept, they must be sure that it works.

All these activities are important, but developing an effective earnings model is arguably the most important of all. The ability to generate revenue is something you need from the outset.

Free money

Another way in which to finance the initial phase is through grants and subsidies. In the Netherlands, we have various business incentive schemes such as the SME Innovation Investment Programme for Regions and Top Sectors and pre-seed funds supported by governments agencies. Start-ups with genuinely innovative ideas can apply for a non-repayable grant of up to €25,000. Unsurprisingly, the programme is massively oversubscribed but a start-up that manages to get its foot in the door will enjoy a significant boost. It is all a question of having a good concept and a little bit of luck. However, no programme will do everything for you. All demand investment on the part of the start-ups themselves. In this context, it is worth mentioning the Innovation Tax Deduction Schemes. It is not a direct grant but a fiscal arrangement designed to promote innovation by reducing the staffing costs of R&D. If you employ someone to develop software, for example, you can reclaim a proportion of the applicable payroll taxes. This is an opportunity that should not be passed up!

Go-to-market

We now find ourselves in the second phase of the start-up: build and launch. A mistake that many entrepreneurs make is to focus solely on product development. They omit to put money aside to fund the activities needed to generate revenue. They have no clear go-to-market strategy. Suppose that the start-up has managed to secure around €100,000 from an angel investor or through crowdfunding. That is just enough to build a viable product, but not enough to cover the necessary marketing activities.

In this phase, you will need access to roughly between €200,000 and €250,000. If you can’t get your hands on that sort of cash, then you must pare back your development budget to the bare minimum and put as much as possible aside to cover marketing and sales until a revenue flow can be established. This money could be used to finance an effective SEA campaign or to hire an experienced Sales Director.

The point at which a company starts to generate income is an important milestone in its life cycle. One of the very first questions that any potential investor will ask is, ‘Is there any turnover yet?’ Your concept is validated by the fact that someone – anyone – is willing to pay for it.

Sell, sell, sell

This is the stage in which many start-ups fail. In most cases, their demise is not because there was anything wrong with the product but because they had insufficient funds to take that product to market. They say that a good product will sell itself. That is no longer true, if indeed it ever was. Even if you have a truly excellent product, you will have to persuade your first customers to buy it. The clear majority of start-up entrepreneurs take great pleasure in developing a product. They are less keen on trying to sell it. It can be disconcerting to discover that other people do not automatically share your enthusiasm. A prime example is Spanx, the American ‘shapewear’ company. Its founder, Sara Blakely, spent the first year going from shop to shop making sure that her products were displayed prominently enough. She tells the story of how she managed to persuade one large retail chain to stock the line in the first place. She met with its chief buyer. Before long she realized that her usual sales pitch was not having the desired effect so she invited the buyer to accompany her to what the Americans delicately term the ‘restroom’. There, Blakely disappeared into a cubicle and emerged wearing nothing but her Spanx underwear. The buyer was, understandably, taken aback but was also impressed enough to place an order for 10,000 garments. An object lesson for start-ups who are so obsessed with their product that they neglect the process of marketing it. In this phase, you must sell, sell, sell!

Convertibles

There has been cautious growth and the start-up enters the next phase of its life cycle. This is a good time to attract funding to support ongoing development. There are various ways of doing so. The convertible loan is one option. Alternatives include crowdfunding or the direct involvement of informal investors. All have the advantage of not requiring any formal valuation of the business, which can be difficult to determine at this stage. Although the company now has some customers, future revenues remain largely guesswork.

The convertible loan structure can be viewed as a sort of halfway house. It is the step you take before you attempt to attract private equity funding or venture capital, the ‘Series A’ investment. Lenders buy convertible bonds which they can convert into a specified number of shares of common stock in the issuing company at a later date. If the start-up really takes off, these investors are first in line and will make a significant return on their investment on exit. Convertibles are already hugely popular in the United States and appear to be gaining ground on crowdfunding platforms in the Netherlands too.

Scale-up

How is this money used? Ideally, it is used to create a substantial customer base and to ensure that the company is operating in profit. In this phase, it must stave off any competition and exploit the first mover’s advantage to achieve market domination. To do so will demand resources of between €1 million and €2.5 million, which can be raised by means of private equity funding, venture capital, crowdlending, an SME stock exchange or a bank loan. A combination of these sources is also possible and indeed preferable, since it would help to maintain a good balance between shareholder equity and borrowed capital. Over-reliance on borrowed capital is the most likely cause of problems at this stage. A creditor could pull the company out from under your feet by foreclosing on a loan, as it may be entitled to do if performance does not meet expectations. You can avoid this risk by maintaining a sound equity ratio: the proportion of total assets financed by shareholders as opposed to those financed by creditors. In broad terms, there are two ways of increasing shareholder equity: by creating a healthy revenue stream (from which reserves are built up) or by issuing stock. If you fail to create adequate equity, you could well fall victim to your own success. Rapid growth costs money: often far more than you think. With a sound equity position, it is easier to attract new capital and you will be in a better position to weather any setbacks.

Towards management

Your role within the company will now change. You are expected to grasp the intricacies of margins and solvency rates. You will be less of an entrepreneur and more of a manager. Are you really the right person for the job or is it now time to bring in other people who do have the necessary qualities? Are you able to delegate responsibilities while maintaining the overall picture? At this stage of the company’s development, you must concern yourself with matters of governance and you will spend much of your time maintaining good relations with your most important customers, suppliers, shareholders, partners, financiers and the regulators. This change of direction is not for everyone. If you are unwilling or unable to adapt to your new responsibilities, it is probably time to step down as director and do something else. Sell part of your shares – but not all of them – so that you have the wherewithal to make a new start.

Conclusions

As we stated at the beginning of this article, half of all start-ups fail to survive beyond five years. Most of those that plummet into the ‘valley of death’ do so just after the build and launch phase. They do not have the money to test the market, they have little or no revenue, and they have no idea how the market will respond to the product. Start-ups that survive and thrive show certain consistent characteristics. They all have a longer-term view and make appropriate financial provisions. They restrict their investment in the product itself to maximize their investment in creating demand: sell, sell, sell! Finally, they are persistent and attract sufficient equity. They are not deterred by financial setbacks and will adapt their product and approach as necessary. Start-up mentality must make way for managerial capacities or a well-timed exit of the founders.

About the author: Pim Betist is a serial entrepreneur, speaker and crowdfunding specialist. With his current company, Ripplestarters, he transform ideas into successful companies. Together with professor Lex van Teeffelen he created this guestpost and did the research.

Photo: Bodine Koopmans