Looking at the funding numbers, the Dutch startup ecosystem is in excellent health! Every year we make a list of all publicly announced startup deals in The Netherlands, and for 2018 we were able to find more than 130 deals, with a median investment amount of 1 million euros.

Why this funding list

The goal of the Startupjuncture funding overview is to provide transparency into the Dutch ecosystem. The list shows that there are many startups that receive funding. We explicitly provide a full list rather than just a total number, to help other people do additional research. We hope the list shows startups what type of startups receive funding in The Netherlands, who the most active investors are, what the typical amount of funding is and at what stage startups can get funding. We are grateful that many investors and startups make this data available, since this data is important for other startups. In our view, having such data helps startups plan their investment strategy.

How the funding list is created

Searching: The list was created by searching the leading Dutch startup blogs for data about investments. Since startupjuncture is less active, we are relying on our colleagues. We would like to thank startup news sites Sprout, Emerce, EU startups and Silicon Canals and public databases dealroom (via startupdelta) and Crunchbase. Also a large thanks to Thomas Mensink from Goldeneggcheck for help with analysis earlier this year.

Selecting: We have used a liberal definition of ‘startup’: we include any investment in an innovative company that intends to scale. If you have a more stricter definition of a startup, feel free to download the list and apply a filter on the data. The top 15 companies of the list are probably more scale-ups than startups: they have already found a business model. We believe however that any good research into startup funding should include these scale-ups as well. It would be very unfair to first exclude the major successes, and then conclude that there are few successful startups.

Estimation: In some cases, the amount of funding is undisclosed. We made an estimation of the funding amount in order to estimate total funding. We do this depending on what funding round it is and the type of investors. Our typical estimate is 500.000 euros since this is a typical seed/first round for a Dutch startup.

Validation: We have only included deals where there is an external source. Nevertheless: mistakes and omissions are possible. If you discover a mistake, please let us know.

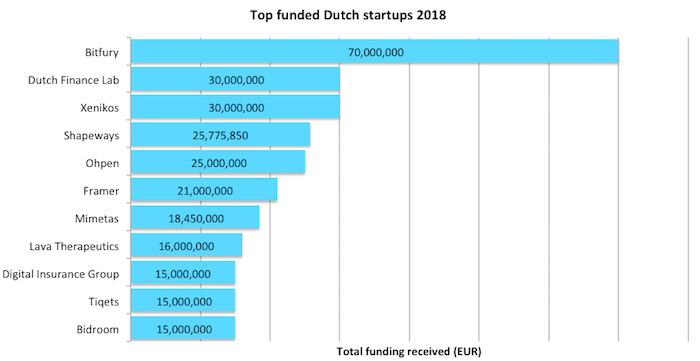

Top startups

There are 11 startups that have received more than 15 million in funding. They are the startups/scale-ups that were most successful in raising funds. This is of course not the same as overall success: some of the most successful business do not need to raise funds.

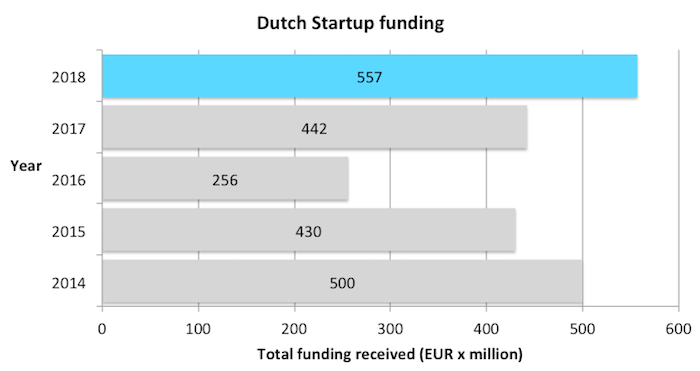

Comparison to previous years

Comparing the total amount of funding is dangerous: one or two outliers have a huge impact on the total. Nevertheless it makes for interesting headlines so in the chart above we have included the totals. 2018 is a normal, good year for funding. There is no sign of a slowdown in startup funding. for more details on the previous years, check the following overviews:

- Startupjuncture Dutch startup funding overview 2014

- Startupjuncture Dutch startup funding overview 2015

- Startupjuncture Dutch startup funding overview 2016

- Startupjuncture Dutch startup funding overview 2017

The full 2018 Dutch startup investment list

This list provides for each startup the amount of funding received, the investors, and a link to the source of the investment information. The list is sorted on (estimated) funding amount. Note that the deals from the first quarter of 2018 are also included in our Q1 2018 funding overview, and the Q2 deals are included in our Q2 funding overview.

image credit: Ray Henessy – unsplash

| Rank | Startup | Investor | Amount | Source |

|---|---|---|---|---|

| 1 | Bitfury | Korelya Capital | € 70,000,000 | silicon canals |

| 2 | Dutch Finance Lab | Pieter Schoen | € 30,000,000 | startupjuncture |

| 3 | Xenikos | Medicxi and RA Capital Management | € 30,000,000 | xenikos |

| 4 | Shapeways | Lux Capital | € 25,775,850 | shapeways |

| 5 | Ohpen | Amerborgh | € 25,000,000 | startupjuncture |

| 6 | Framer | Atomico, Accel | € 21,000,000 | silicon canals |

| 7 | Dott | EQT Ventures and Naspers Ventures | € 20,000,000 | finsmes |

| 8 | Mimetas | ELSG, Aglaia Oncology, Korys, Cathay, Innovation Quarter, OostNL | € 18,450,000 | mimetas |

| 9 | Lava Therapeutics | Gilde Healthcare and Versant Ventures | € 16,000,000 | Lava Therapeutics |

| 10 | Digital Insurance Group | Zurich Insurance and Finch Capital | € 15,000,000 | finsmes |

| 11 | Tiqets | HPE growth capital | € 15,000,000 | HPE |

| 12 | Bidroom | undisclosed | € 15,000,000 | silicon canals |

| 13 | VarmX | BioGeneration Ventures and Innovation quarter | € 12,500,000 | silicon canals |

| 14 | Luxexcel | Innovation Industries and previous investors | € 12,000,000 | bits&chips |

| 15 | Effect.AI | ICO | € 11,000,000 | crunchbase |

| 16 | GreenFlux | Eneco, SET Ventures, BOM, ICT Group | € 11,000,000 | sprout |

| 17 | Fastned | bond issue | € 11,000,000 | silicon canals |

| 18 | Black Bear | Chemelot Ventures, ING Sustainable Investments, Stitching DOEN, SCG, Social Impact Ventures and 5square | € 11,000,000 | silicon canals |

| 19 | Zivver | Dawn Capital, DN Capital, HenQ | € 11,000,001 | zivver |

| 20 | Etergo | a German automotive specialist | € 10,000,000 | silicon canals |

| 21 | Impraise | Keen Venture and HenQ | € 9,500,000 | silicon canals |

| 22 | Photanol | GROEIfonds, Investeringsfonds Groningen | € 8,000,000 | photanol |

| 23 | Cobase | ING ventures | € 7,500,000 | silicon canals |

| 24 | Mosa meat | Bell Food Group and Merck | € 7,500,000 | silicon canals |

| 25 | HousingAnywhere | Vostok New Ventures | € 6,000,000 | baaz |

| 26 | VirtuaGym | Endeit capital | € 6,000,000 | virtuagym |

| 27 | Mews | HenQ | € 6,000,000 | HenQ |

| 28 | SMART Photonics | informal investors | € 6,000,000 | smartphotonics |

| 29 | ParkBee | Statkraft, InnovationQuarter | € 5,000,000 | startupjuncture |

| 30 | Lightyear | private investors | € 5,000,000 | ED |

| 31 | Cleeng | C4, Walvis participaties | € 5,000,000 | emerce |

| 32 | Hardt | InnoEnergy | € 5,000,000 | silicon canals |

| 33 | Instant Magazine | Connected capital, Newion | € 4,500,000 | silicon canals |

| 34 | Screenpoint Medical | Siemens Healthineers and private investors | € 4,300,000 | Radboud UMC |

| 35 | OneFit | INKEF Capital | € 4,250,000 | Sprout |

| 36 | Connecterra | Sistema VC and AG funder | € 4,200,000 | Agfundernews |

| 37 | Innecs Power Systems | Finindus, ENERGIIQ and BOM | € 4,000,000 | duurzaambedrijfsleven |

| 38 | Blendle | Morten Strunge and BookSpot | € 4,000,000 | nu.nl |

| 39 | Roadmap | Newion Investments | € 4,000,000 | sprout |

| 40 | Temper | Slingshot | € 4,000,000 | silicon canals |

| 41 | Bambi Medical | informal investors | € 4,000,000 | ED |

| 42 | Harver | Insight Venture Partners | € 3,900,000 | startupjuncture |

| 43 | SemiBlocks | BOM | € 3,000,000 | sprout |

| 44 | Crisp | undisclosed | € 3,000,000 | silicon canals |

| 45 | Felyx | private investors and ABN AMRO bank | € 3,000,000 | EU-startups |

| 46 | Fairphone | crowdfunding via oneplanetcrowd | € 2,500,000 | silicon canals |

| 47 | Beyond Sports | Triple IT | € 2,400,000 | sprout |

| 48 | blanco | Volta Ventures and KBC Start it Fund | € 2,000,000 | blanco |

| 49 | Knowingo | Airbridge | € 2,000,000 | airbridge |

| 50 | Exasun | ING Sustainable Investments, ENERGIIQ, ABN Amro | “several millions” | innovationquarter |

| 51 | Phenospex | LIOF | € 2,000,000 | futurefoodfund |

| 52 | Solease | Crwdfunding via Duurzaaminvesteren | € 2,000,000 | silicon canals |

| 53 | Aectual | AKEF, DOEN Participaties and American company | € 1,800,000 | sprout |

| 54 | Kepler Vision Technologies | UVA Ventures, Stokman | € 1,700,000 | vectrix |

| 55 | healthy workers | Cairn Real Estate | € 1,500,000 | emerce |

| 56 | Avular | Lumipol Holding | € 1,500,000 | sprout |

| 57 | Physee | undisclosed | € 1,500,000 | bright |

| 58 | Wonderflow | P101 (Italy) | € 1,500,000 | tech.eu |

| 59 | Factris | Speedinvest Fintech | € 1,500,000 | silicon canals |

| 60 | MRIguidance | Health Innovations | € 1,500,000 | silicon canals |

| 61 | Rex.AI | Newion ventures | € 1,500,000 | silicon canals |

| 62 | LeydenJar Technologies | UNIIQ, BOM | € 1,450,000 | |

| 63 | Nowi | Disruptive Technology Ventures | € 1,400,000 | |

| 64 | Openclaims | Velocity Capital and Tablomonto | € 1,300,000 | emerce |

| 65 | Salvia BioElectronics BV | BOM) and Thuja | € 1,300,000 | innovationorigins |

| 66 | Stapp.in | Taxi Baan and Houttequiet and investment fund Silicon Polder Ventures | € 1,300,000 | silicon canals |

| 67 | Hardt | Block Party (Gregory van der Wiel) | € 1,250,000 | startupjuncture |

| 68 | Swipeguide | Newion Investment | € 1,000,000 | startupjuncture |

| 69 | Blockport | ICO | € 1,000,000 | startupjuncture |

| 70 | Inkless | Angel investors | € 1,000,000 | inkless |

| 71 | MindAffect | OostNL, Bernard Muller | € 1,000,000 | nu.nl |

| 72 | Homerr | CNBB Venture Partners | € 1,000,000 | emerce |

| 73 | The Next Closet | PDENH, anneke Niessen | € 1,000,000 | sprout |

| 74 | Peel Pioneers | BOM, Stichting Doen and ABN Amro | € 1,000,000 | peelpioneers |

| 75 | Attrace | undisclosed | € 1,000,000 | perssupport |

| 76 | BridgeFund | undisclosed | € 1,000,000 | bridgefund |

| 77 | Travelbags | RTL Ventures | € 1,000,000 | schoenvisie |

| 78 | Brenger | Tablomonto | € 950,000 | silicon canals |

| 79 | Voltea | Unilever, Rabobank, ETF, Anterra | € 900,000 | crunchbase |

| 80 | Quicargo | Angel investors | € 900,000 | emerce |

| 81 | Srprs.me | crowdfunding | € 900,000 | silicon canals |

| 82 | Correspondent | Pierre Omidyar | € 800,000 | emerce |

| 83 | ScanMovers | angel investors | € 750,000 | EU startups |

| 84 | FlorAccess | group of e-commerce investors | € 750,000 | startupjuncture |

| 85 | Otrium | Fred Gehring (ex-CEO) and Ludo Onnink (ex-CFO) and Adriaan Mol | € 750,000 | startupjuncture |

| 86 | Loqed | Nextstage | € 700,000 | vectrix |

| 87 | Objectiv | Dutch entrepreneurs | € 684,320 | venture beat |

| 88 | Flex-appeal | two informal investors | € 600,000 | startupjuncture |

| 89 | IMSystems (Archimedes Drive) | InnovationQuarter en Lucros Investment | € 600,000 | innovation quarter |

| 90 | Geospark | Airbridge | € 500,000 | finsmes |

| 91 | Picturae | Karmijn | undisclosed | karmijn |

| 92 | EST-Floattech | Rotterdam Port Fund | undisclosed | portofrotterdam |

| 93 | Unit040 | BOM and Parinvest | undisclosed | emerce |

| 94 | Kriya Materials | Henkel | undisclosed | chemelot |

| 95 | Triple Solar | DOEN Participaties and PDENH | undisclosed | solarmagazine |

| 96 | Ockto | ABN Amro | undisclosed | iex.nl |

| 97 | GoodFuels | Social Invest Ventures | undisclosed | consultancy.nl |

| 98 | One Of A Kind Technologies | Gimv | undisclosed | OOAKT |

| 99 | Fiberneering | OostNL | undisclosed | oostNL |

| 100 | 360SportsIntelligence | OostNL | undisclosed | oostNL |

| 101 | Dobbi | PostNL, Henkel | undisclosed | sprout |

| 102 | Onera | BOM | undisclosed | silicon canals |

| 103 | Zummit | Van der Meijden Investment | undisclosed | computable |

| 104 | Fibonacci | Van der Meijden Investment | undisclosed | computable |

| 105 | GoCredible | Rabo Frontier Ventures | undisclosed | emerce |

| 106 | Jules | LIOF | € 500,000 | chapeau |

| 107 | Vertoro | Chemelot Ventures, LIOF | € 500,000 | chemelot |

| 108 | Joindata | Rabo Frontier Ventures | undisclosed | emerce |

| 109 | Volgroen | PDENH and DOEN | undisclosed | solarmagazine |

| 110 | Wellsun | Thomas Borsboom and Lucas van Reeken | undisclosed | wellsun |

| 111 | Unless | Block Party (Gregory van der Wiel) | undisclosed | computable |

| 112 | Sneleentaxi | Symbid crowdfunding | € 500,000 | silicon canals |

| 113 | Dyme | ASIF | undisclosed | silicon canals |

| 114 | Edubookers | BOM | undisclosed | silicon canals |

| 115 | Alledaags | Nextgen Ventures | € 500,000 | silicon canals |

| 116 | EAVE | Forward.one | undisclosed | Forward.one |

| 117 | Sjoprz | Liof | undisclosed | LIOF |

| 118 | Plasmacure | Oost NL and private investors | undislosed | ED |

| 119 | EFFECT Photonics | Undisclosed | undislosed | bits&chips |

| 120 | Careibu | undisclosed | € 400,000 | silicon canals |

| 121 | ContentKing | a group of informal investors | € 350,000 | startupjuncture |

| 122 | Cafedeco | Herman Veenendaal, Mike Zwolle, and another investor | € 300,000 | EU startups |

| 123 | Concord neonatal | UNIIQ | € 300,000 | startupjuncture |

| 124 | Innovative Mechatronics | UNIIQ | € 300,000 | uniiq |

| 125 | SunData | DOEN | € 300,000 | Sundata |

| 126 | Oceans of Energy | UNIIQ | € 300,000 | sprout |

| 127 | Voitures Extravert | undisclosed | € 300,000 | voitures-extravert |

| 128 | Numeric Biotech | UNIIQ and Erasmus MC | € 300,000 | numericbiotech |

| 129 | Closure | Janneke Niessen | € 300,000 | silicon canals |

| 130 | Plek | via Voordegroei | € 300,000 | silicon canals |

| 131 | Shypple | Brabant Development Cooperation (BOM) | 250000 (estimated) | startupjuncture |

| 132 | DFFRNT Media | Talpa Network | 250000 (estimated) | startupjuncture |

| 133 | Voicey | Block Party (Gregory van der Wiel) | € 250,000 | startupjuncture |

| 134 | EAZ Wind | Groninger Economisch Investeringsfonds | € 200,000 | energeia |

| 135 | Eco-movement | Arches Capital | € 200,000 | silicon canals |

| 136 | Blockdata | undisclosed | € 200,000 | silicon canals |

| 137 | LessonUp | Peak capital | € 100,000 | sprout |

| 138 | Batchforce | Peak capital | € 100,000 | sprout |