Raising money isn’t easy. Some startup founders therefore want to get funding once, and be done with it. Is this smart? Joachim Blazer finds out.

Raise 1 round

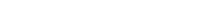

Have a look at the following calculations.

-Where does my cash curve bottom out? Assume at -/- $1.7m. So I need to raise $1.7m.

-What is my exit value? Assume $32.2m.

-What internal rate of return (IRR) does a Series-Seed investor want to make on his portfolio? Assume 10.0%.

-When will the series-seed investor sell his shares? Assume after 5 years.

-A 10.0% internal rate of return on his portfolio and 5 years till exit means the series-seed investor has to make a 1.6x money multiple (MM) on his portfolio.

-How many milestones do I have to achieve between Series Seed and exit? Assume 5 milestones.

-What is the probability of success per milestone? Assume 63.1%.

Five milestones with a 63.1% probability per milestone result in a 10.0% probability of success for my startup at the time I raise a series seed.

A 1.6x money multiple and a 10.0% probability results in a 16.1x money multiple for my startup.

A $32.2m exit value and a 16.1x money multiple result in a $2.0m valuation.

A $1.7m investment at a $2.0m valuation means I must issue the series seed investor 85.0% new shares.

Raise 2 rounds

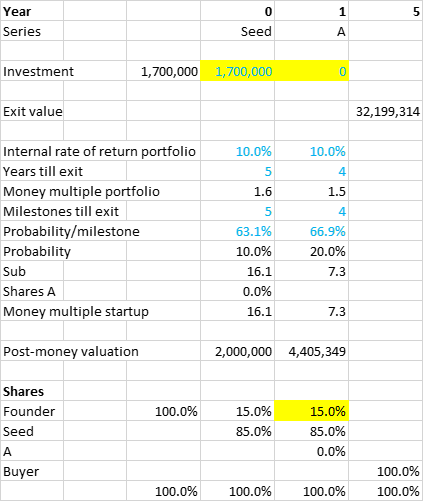

Now let’s compare this to two rounds:

-I need to raise $1.7m.

-How much money do I need to achieve my first milestone? Assume $200k.

-And my second milestone? Assume $1.5m.

Series A

-What internal rate of return does a series A investor want to make on his portfolio? Assume 10.0%.

-When will the series A investor sell his shares? Assume after 4 years.

A 10.0% internal rate of return on his portfolio and 4 years till exit means the series A investor has to make a 1.5x money multiple on his portfolio.

-How many milestones do I have to achieve between series A and exit? Assume 4 milestones.

-What is the probability of success per milestone? Assume 66.9%.

Four milestones with a 66.9% probability per milestone result in a 20.0% probability of success for my startup at the time I raise series A.

A 1.5x money multiple and a 20.0% probability results in a 7.3x money multiple for my startup.

A $32.2m exit value and a 7.3x money multiple result in a $4.4m valuation.

A $1.5m investment at a $4.4m valuation means I must issue the series A investor 34.0% new shares.

Series seed

Because I issue the series A investor 34.0% new shares, I must correct the series-seed money multiple to 16.1x / (1 – 34.0%) = 24.4x. Otherwise the series seed investor will not achieve his target internal rate of return because of dilution.

A $32.2m exit value and a 24.4x money multiple result in a $1.3m valuation.

A $200k investment at a $1.3m valuation means I must issue the series seed investor 15.2% new shares.

2 rounds is the way to go

If I raise $1.7m in 1 round, I end up with 15.0% of the shares. Oomph. That’s not good. Then I might just as well become an employee somewhere.

If I raise the same $1.7m investment in 2 rounds, I end up with 56.0% of the shares. That’s more like it.

Fun fact

Even though my series seed valuation is lower ($1.3m instead of $2.0m) I end up with more shares. Go figure.

Thanks to Hans Westerhof and Chretien Herben.

Joachim Blazer is a corporate finance advisor. He helps founders raise money. Contact him at hello@joachimblazer.com. The original article appeared on his blog first.

Joachim Blazer is a corporate finance advisor. He helps founders raise money. Contact him at hello@joachimblazer.com. The original article appeared on his blog first.

Image: ErikaWittlieb @ Pixabay