What is an anti-dilution clause and what does that mean for founders, investors, and the amount of shares? Joachim Blazer explains and reveals the numbers behind such a construction. From term sheet to spreadsheet.

Guestpost by Joachim Blazer

I just received a term sheet for a Series Seed preferred share deal. It says: “For the Investors an anti-dilution clause applies for future issuances below the price paid by the Investors.”

The shareholders’ agreement further specifies what this means: “If the Company issues new Shares or securities convertible into Shares at a purchase price lower than the purchase price the Investors have paid for their Shares in accordance with this Agreement, the Investors have the right to acquire new Preferred Shares against payment of such an amount that the average purchase price they have paid is equal to the purchase price at which the new Shares are issued.”

All clear? Uhm… no.

Let’s translate this term sheet into a spreadsheet.

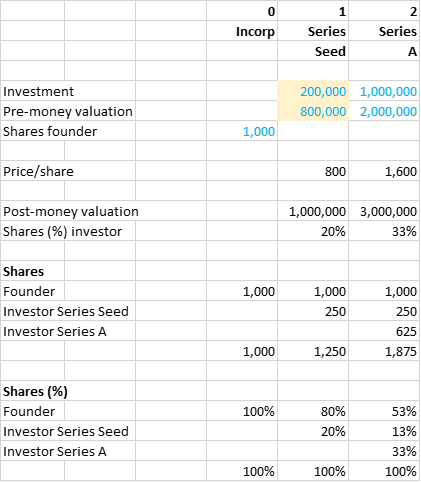

Scenario 1: Up Round

Given my cashflow planning, I expect that I also need to raise a Series A. Assume $1m at $2m pre-money. That means a price of $2m / 1,250 = $1,600 per share.

This is an up round because $1,600 is more than the previous round’s price of $800 per share. Therefore, the anti-dilution clause is not triggered.

The Series Seed investor keeps his 250 shares.

The Series A investor gets $1m / $1,600 = 625 shares.

After the Series A is raised I own 1,000 / 1,875 = 53% of the shares.

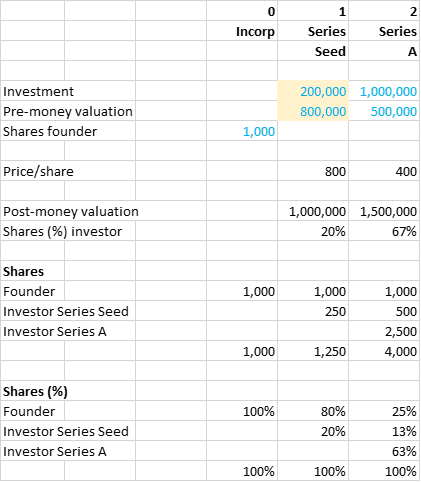

Scenario 2: Down Round

Now assume I need to raise my $1m Series A at (a really horrible) $500k pre-money. That means a price of $500k / 1,250 = $400 per share.

This is a down round because $400 is less than the previous round’s price of $800 per share. Therefore, the anti-dilution clause is triggered.

The Series Seed investor should have $200k / $400 = 500 shares. He has 250 shares. So he gets issued 500 – 250 = 250 extra, free shares to make him whole.

The Series A investor gets $1m / $400 = 2,500 shares.

After the Series A is raised I own 1,000 / 4,000 = 25% of the shares.

But wait. The Series A investor wants to invest $1m at $500k pre-money. That means he wants $1m / $1.5m = 67% of the shares. He only receives 2,500 / 4,000 = 63% of the shares. Something goes wrong because of the 250 extra shares for the Series Seed investor.

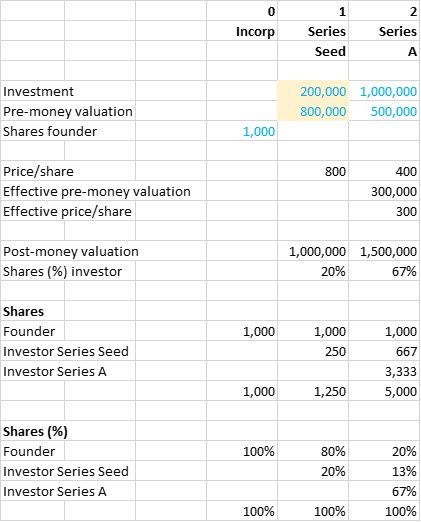

Scenario 2: Down Round – Revisited

Time for a trick.

The effective pre-money valuation is $500k – $200k = $300k. That means an effective price of $300k / 1,000 = $300 per share.

The Series Seed investor should have $200k / $300 = 667 shares. He has 250 shares. So he gets issued 667 – 250 = 417 extra shares.

The Series A investor gets $1m / $300 = 3,333 shares.

After the Series A is raised the Series A investor owns the 3,333 / 5,000 = 67% of the shares that he wants.

I own 1,000 / 5,000 = 20% of the shares.

Now I get how anti-dilution works.

Thanks to Hans Westerhof and Chretien Herben.

Joachim Blazer is a corporate finance advisor. He helps founders get the best venture deals. Contact him at hello@joachimblazer.com. This post appeared first on his blog.

Main image by StartupJuncture, made with Infogr.am.